Schengen Visas in Tunisia: Investing in Human Misery

“It’s all about supply and demand.” That simply, the general director of TLScontact in North Africa summarized – in a radio program on 1 May 2023 – the problems occurring in Tunisia and several Maghrebi countries regarding the filing of applications for visas to France and other Schengen Area countries.

Recently, applicants have been forced to wait for months for an appointment to file an application and many weeks for the Consulate’s response. These new blockages have created an informal market of intermediaries, whether travel agencies or individuals who provide “appointments” (originally free) for sums sometimes exceeding TND1,000 [USD320]. This was the context of the above statement by the general director of TLScontact, which is one of the leading private companies operating in Tunisia – among dozens of other countries – in the realm of collecting visa applications for Schengen Area and other Western countries. He said that the main cause of the current crisis lies beyond the actions of his company. According to him, many Tunisians filed applications when the COVID-19 pandemic and the associated lockdowns and travel restrictions (2020-2021) began receding in early 2022, putting much pressure on the private service providers that receive the applications and the consulate departments that examine and decide on them. The French consul offered essentially the same justification during a press interview on 4 May 2023: the increase in demand for visas coincided with the emergence of private businesses and consulate departments from the pandemic period, which required reorganization and re-acclimatization; thereby slowing down procedures.

But is COVID-19 the main or sole reason for the decline in the pace at which applications are being taken and visas granted? The available figures raise doubts. In 2019, Tunisians filed 170,552 applications for a French visa (out of a total of 247,563 applications that they filed to enter the Schengen Area), and 125,633 were approved (out of a total of 180,536 Schengen visas obtained by Tunisians). But in 2022, they submitted just 95,515 applications (i.e. approximately 75,000 fewer) and obtained 64,209 visas. So where is the supposed pressure? Adding to our doubts, the number of applications for Schengen visas in all countries around the world declined from 17 million in 2019 to 7.5 million in 2022. It appears that the drop in the pace of visa-granting stems more from a political decision than from technical factors. Recall that in September 2021, France decided to reduce the number of visas granted to Tunisians by 30% as a punishment for Tunisia’s reluctance to provide the documents needed to deport Tunisian migrants residing “illegally” in France. The director of TLScontact in Tunisia denied that the business is responsible for the cumbersome application procedures, pointing out that this lag is not in its interest: “We are paid per application”. When asked whether the French embassy had set a limit on the number of paid applications per year, he said no, although he did not deny that from time to time there are instructions to reduce the pace at which applications are sent to consulate departments.

Suspicions about the true causes of the current visa crisis are reinforced by the fact that the campaign denouncing the policies of the French Embassy and TLScontact in Tunisia have yielded some results. On 26 May 2023, French Consul in Tunisia Dominique Mas announced that the service cost for receiving the application (not the cost of the visa itself) was being reduced from EUR33 to EUR28, and two new application centers were being opened in Tunis and Sfax. In other words, solutions exist when the embassy has the will to provide them.

However, the situation is too complicated to be solved by merely facilitating the flow of applications and reducing the cost by a few dinars. European immigration policies over the last three decades, which are growing ever harsher, have created a new “economic sector” that could be called the “visa market”. Because Tunisia has longstanding and resurging traditions of migration and approximately 1.5 million citizens living in Schengen countries, it has a key stake in this market and its fluctuations.

Fortress Europe Commodifies Visas

The Schengen visa crisis afflicting Tunisians today is only the tip of the iceberg. The crisis is larger and its roots deeper. The 1970s witnessed the end of the “Glorious Thirty” – the thirty-year period of reconstruction and economic revival that began in Europe after it was devastated by the Second World War. Migrant workers coming from countries of the Maghreb, Sub-Saharan Africa, and other poor regions had played a vital role during the “Glorious Thirty” period as young, low-cost labor. However, as growth rates slowed down starting in the 1970s, many European countries sought to shed these “foreign bodies” or at least close their doors to new arrivals. For example, beginning in September 1986, France began requiring an entry visa from citizens of many Global South countries, and several other European countries followed suit. A short time earlier – specifically in June 1985 – five European countries (West Germany, France, Belgium, Holland, and Luxembourg) signed the Schengen Agreement, which would be the basis of the Schengen Convention in 1990 and would enter into effect in March 1995, allowing citizens of the member states to move freely among them.

After the establishment of the European Union in 1993, its member states agreed to incorporate the “Schengen acquis” into shared European legislation. The borders of the Schengen Area thereby expanded as the number of its member states gradually increased to 27. While hundreds of millions of Europeans began enjoying freedom of movement without a passport or visa, the walls of “Fortress Europe” began rising day by day, indicating to billions of people in the Global South that they are unwanted and must go through hell to reach paradise. This was especially true after the Treaty of Amsterdam entered effect in May 1999 and the uniform European visa code was passed in July 2009.

The tightening of European immigration and visa policies primarily targeted the poorest countries (most of them former colonies of European empires) as a reservoir of irregular migrants who must be prevented from invading Europe. Because of these measures and perceptions, new, demeaning and even deadly phenomena emerged in the target countries, including Tunisia.

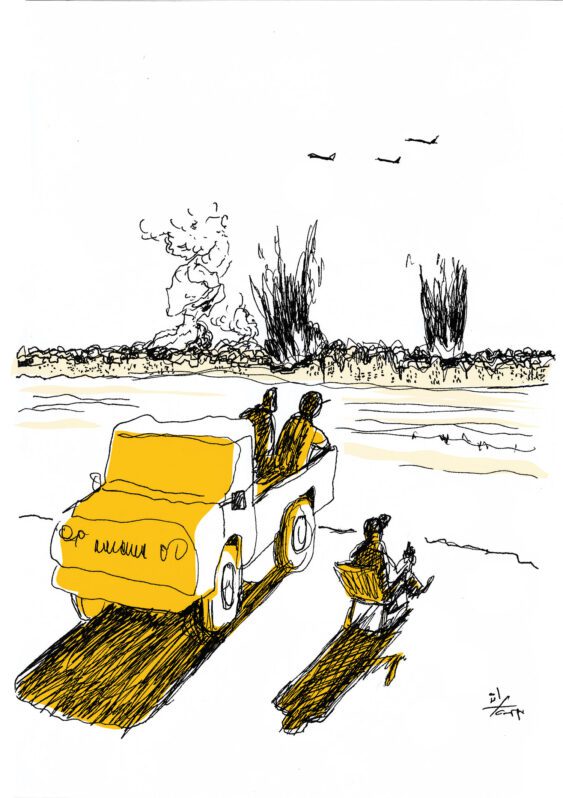

Many Tunisians undoubtedly remember the long queues amassed under the sun and rain in front of European consulates in Tunis and other major cities such as Sfax. There were no appointments for filing visa applications. People would come from several cities in the early hours of the morning, with some even spending the night in the open air near the consulates. With the increasing visa requirements – which became a filter based on socioeconomic or academic distinction – and successive rejections of applications, many people seeking to travel to Europe became convinced that they would never do so via the regular crossings and must pursue “illegal” means. So began the harqa – a Tunisian colloquialism for irregular migration – that has persisted, with all its tragedies, for approximately three decades.

During roughly the same period, i.e. the end of the 1980s and following the breakup of the Soviet Union and ascendance to global dominance of the neoliberal ideology, the world began to witness major economic changes primarily involving the “international division of labor”, labor laws, and manufacturing process management. New concepts such as offshoring (whereby Western companies move their operations to Global South countries), subcontracting, and outsourcing began to dominate the labor market. These concepts all aimed to increase the profits of major companies by reducing their financial burden and social responsibility for entire stages and sectors of production and capitalizing on low-cost labor, foreign investment concessions, and the “flexibility” of labor laws in developing countries. These concepts were initially popular primarily in the private industrial sector. However, they spread to the services industry and allured governments with the promise of reduced public spending and maximum efficiency, even reaching the visa-issuing process, which is a distinctly sovereign affair.

In the mid-2000s, Schengen governments began entrusting private companies – the first being VFS Global – with one or multiple stages of the application process, including setting appointments over the phone, providing guidance, collecting the necessary documents, data entry, and other services. Since 2010, the number and activities of these companies have increased such that they now dominate the entire application process, from the filing of the application to the recovery of the passport. The role of European diplomatic missions and government agencies is now limited to deciding whether to approve or reject the applications. Of course, these companies provide their services for a fee paid not by the contracting governments but by the applicants. Thus, a booming market with millions of customers each year, who pay billions destined for multinational companies’ accounts and European states’ coffers, was born.

This historical background sheds light on how “outsourcing” companies settled in Tunisia and how their activity evolved. Tunisians’ applications for Schengen visas are constantly increasing, climbing gradually from 152,038 in 2014 to 247,563 in 2019. The number would probably have continued increasing were it not for the pandemic and the obstacles that European countries have recently imposed. The market for collecting visa applications is split, with differing shares, among four main companies:

- TLScontact Tunisie began operating in Tunisia in April 2012 after it signed a contract with the French Embassy. The company attracted other customers such as the German, Belgian, British, Luxembourgian, Lithuanian, and Latvian embassies. As France and Germany account for more than 75% of applications in Tunisia (according to figures for 2019 and 2022), TLScontact is the largest provider of visa services in the country. It is a branch of the French TLScontact, which operates in 90 countries, runs more than 150 centers, collects approximately four million applications per year, and employs over 2,100 people. It is owned by the multinational megacorporation Teleperformance, which is the 11th largest in the world.

- Almaviva Tunisie began operating in Tunisia in 2002 in the call center industry. In June 2014, the company signed a contract with the Italian Embassy to collect visa applications. Italy is still the company’s only customer, although it is the fourth most popular destination for visa applicants in Tunisia (approximately 15,000 applications per year). The company is a branch of the Italian corporation Almaviva (the third largest in Italy), which processed over USD1 billion in transactions in 2022 and employs over 46,000 people in its companies and branches around the world.

- VFS Global began operating in Tunisia in April 2016. It collects visa applications for the Swiss, Austrian, Dutch, Greek, Maltese, Finnish (along with Swedish, Norwegian, and Danish), Slovenian, and Slovakian embassies, as well as the Canadian Embassy. Despite having this many customers, the company collects only a few thousand applications per year as the contracting countries are not the main destinations for Tunisians. It is a branch of the global visa market giant VFS Global, which is an originally Swiss company that was established in India in 2001 and then moved its offices to Zurich (Switzerland) and Dubai (United Arab Emirates). Its ownership has been transferred among European and American investment funds. Today, it operates in 145 countries, works with 67 governments, and employs over 11,000 people. In 2019, the company collected over six million applications.

- BLS International entered the Tunisian market in December 2016 after it contracted with the Spanish embassy, which is its only customer in Tunisia and its main customer around the world. It collects between 15,000 and 18,000 visa applications from Tunisians seeking to visit Spain (the third most popular destination, after France and Germany and before Italy). It is a branch of an Indian company with the same name, which was established in New Delhi in 2005, has opened branches in 62 countries, and employs over 20,000 people. The company processed 11 million applications in 2018, and it processed more than USD160 million in transactions in 2021.

In addition to the visa fees (currently EUR80 for a short-term visa and EUR99 for a long-term one), which go to the consulate departments, the companies receive a service fee from the applicants. BLS International takes TND57 [USD18], Almaviva Tunisie takes TND68.3 [USD22], TLScontact takes between TND80 and TND110 [USD25 to USD35], and VFS Global takes TND130 [USD40]. Given the significance of these fees, the Legal Agenda emailed the companies’ local branches in Tunisia and their headquarters for information about their legal and tax status as foreign companies, their annual transactions figure, and the number of Tunisians they employ. None responded. Based on a simple calculation, and if we assume that approximately 150,000 applications are filed per year at TND80 [USD25] each, the revenue would be approximately TND12 million [USD3.8 million], and the visa fees would amount to approximately three times that figure. In other words, the visa market in Tunisia is worth around TND50 million [USD16 million] in transactions per year, not to mention the money spent on inter-governorate transportation, photographs, obtaining the various documents, travel insurance certificates, and so on. Nevertheless, the visa companies are still greedy for more profit. In addition to receiving visa applications, they provide a package of extra services to their customers, naturally for a fee that is sometimes exorbitant.

Does Digitization Ease Applicants’ Suffering?

In September 2020, the European Union unveiled a New Pact on Migration and Asylum. Despite some “good intentions” expressed in the pact’s text, in every respect it represents a tightening of the policies fortifying Fortress Europe’s walls, not only against potential migrants but even against asylum seekers. I will not delve into all the pact’s details. However, there is an important point concerning visas: the pact stipulates the complete digitization of the process of requesting and granting visas by the end of 2025. Hence, on 27 April 2022, the European Commission presented a legislative initiative to digitize visas. On 29 March 2023, the initiative was approved by the representatives of the European Union’s member states, and they gave the green light to the Council of Europe to begin negotiating it with the European Parliament. Essentially, the legislative initiative establishes a unified online platform for filing applications for visas to every Schengen country, which will presumably be issued in digital form (a QR code with an encrypted digital signature) instead of the sticker currently used.

The procedures announced will allow applicants to submit an application online, except when it is their first application (because of the need to collect biometric data), they are renewing their passports, or over 59 months have elapsed since their biometric data was last collected. The member states reserve the right to ask applicants to attend in person when they suspect fraud or forgery. Thus, anyone seeking to visit a European Union country can use the unified website to obtain all the information and the list of required documents and then apply online, paying the fees using remote payment methods.The digital visa or rejection decision is then delivered via email.

The published texts do not explain the potential effect of digitizing the visa process on the fees requested or the operations and profits of the service providers currently collecting applications in their traditional paper form. What is certain so far is that digitization will reduce the “real” financial cost, the time wasted, and the physical effort for applicants who would otherwise travel hundreds of kilometers several times over a few days or weeks. However, we should not delude ourselves about the impetus for digitizing visas. Although the authors of the legislative initiative stress the advantages in terms of securing personal data, easing the procedures for applicants, and accelerating the processing of applications, the main motivations seem clear: reduce the scope for “fraud and forgery” that the issuance of visas in the form of paper stickers provides, and constrict the “maneuvering leeway” allowing applicants to try their luck with the Schengen countries that they believe are more lenient than their true destination country. The platform’s goals include standardizing procedures and requirements in all member states and reducing the cost of collecting, processing, and examining the applications for European governments.

“Even if there are, of course, rejections, 75% of visa applications filed to our consulate apparatuses are approved and their applicants are granted visas. I believe that this figure is worth contemplating as it gives a picture far removed from a closed-off and isolationist France that obstructs the movement of citizens between it and Tunisia.”

So said French Ambassador André Parant on a Tunisian radio station on 5 October 2022. He was responding to criticisms that the host relayed from many disgruntled Tunisians about the slow, complicated, and sometimes demeaning procedures they must endure to submit a visa application, in addition to the high financial cost (the visa fees and the service fees paid to official or unofficial intermediaries) and the many rejections. The percentage the ambassador presented is accurate but disingenuous as it pertains to the tens of thousands who manage to pass the initial socioeconomic and security screening and are considered minimally acceptable by the European Union’s immigration policies. There are hundreds of thousands, perhaps millions, of Tunisians who do not bother or dare to submit applications in the first place as they know that they are unwanted and their path is “totally blocked”. Many realize that the only “visa” they could obtain is the one granted by people smugglers who offer a space on the “death boats” attempting to penetrate Fortress Europe’s bulwarks.

Mapped through:

Asylum, Migration and Human Trafficking, Tunisia

Related Articles