Lebanese Land Commodification Eclipses Right to Housing

“In 2009, I took out a subsidized loan of LL102 million from the Public Corporation for Housing for a 160m2 apartment in Beddawi, Tripoli. At the time, my income was LL1.2 million, and the monthly payment was LL685,000. I ran myself ragged a thousand times so I could pay the installment. Now I’m unemployed. I can’t find any opportunity, and I can’t even pay for my family’s daily sustenance.”

“I have three children. My wife was dismissed from her job more than six months ago, while I’m getting half my wage now, which covers less than two thirds of the loan’s promissory note. I support my father and mother, who suffer from chronic illnesses and cancer, so I pay enormous amounts for their treatment. My sister is divorced and lives in the family home, and I support her and her child. Now, we are at risk of homelessness, and we’ve fallen into poverty.”

“My wife and I were working. Four years ago, she suffered a medical condition and stopped working. I asked the bank several times to heed my circumstances as I can’t pay because my salary isn’t enough. It refused, saying that the matter has nothing to do with it. I couldn’t pay the last three payments, so the bank asked me to get ready for it to take the home. I said, I have children and you know the state of the country. The bank responded, it’s not our fault, sort something out for them. How am I going to do that?”

This is a sample of the testimonies of hundreds of people who could not continue their home loan payments after – or even before – 2019, the beginning of Lebanon’s economic crisis. The Lebanese economy is closely linked to housing policies, which have clearly been exploited to revitalize the rentier economy rather than promote the right to housing.[1] This approach is a blatant violation of socioeconomic rights and the primary source of housing inequality.

As the above testimonies indicate, the lowest income earners are the most liable to default on home loan payments even though their loans are small and they purchase the cheapest homes in the poorest areas. This is because compared to higher-income borrowers, they spend more of their monthly income on loan installments. Hence, loan burden is inversely proportional to loan size and increases the vulnerability of a group that was already more precarious.[2] Making matters worse, low- and middle-income earners have no choice for accessing safe and sustainable housing other than home loans. Rent, as a social system producing equity in housing and property regulation, has been constrained. Similarly, the ruling class has destroyed the tools of urban planning and programs that help to produce housing that matches people’s capabilities and needs. It has also constricted the possibility of developing communal means of housing that transcend the private property and sole ownership paradigm, such as housing cooperatives. Since the 1990s, successive governments have adopted home loans as a singular approach. Loans were promoted as a response to escalating housing needs, but they actually served the financial goal of strengthening the banking and real-estate sector at the expense of the right to housing.

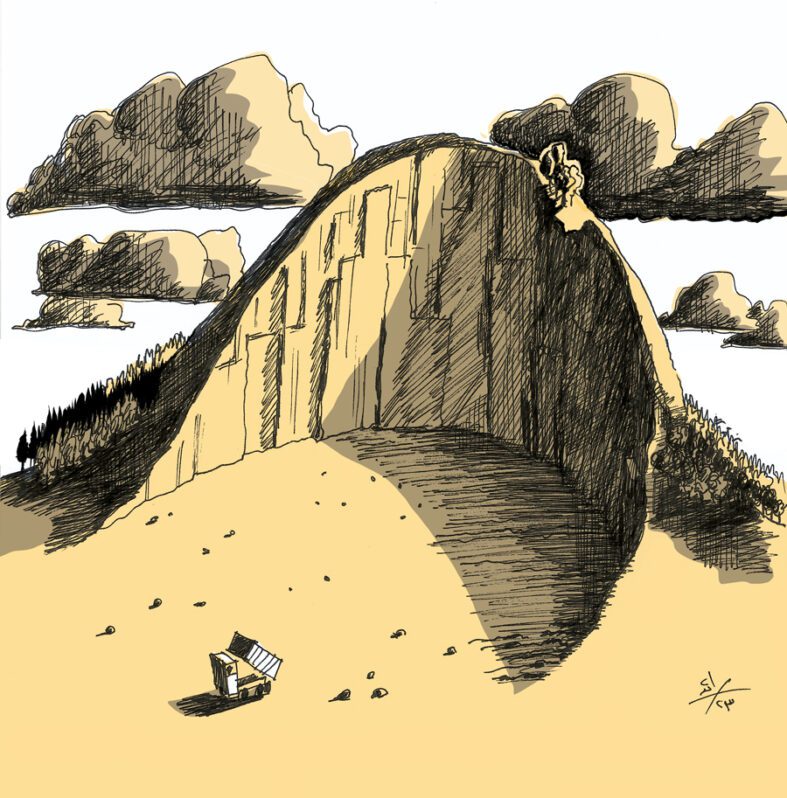

Fundamentally, this approach considers land a commodity that can be repeatedly reproduced through property speculation instead of determining its socioeconomic value primarily through usage. The commodification of land allowed it to be financialized and robbed of its social function, producing cities characterized by disjointed neighborhoods; a housing stock that is vacant, overpriced, or poor; displacements; and constant anxiety about losing housing security, one of the most important pillars for building modern societies.

How were the policies able to strip land of its social function and keep the right to housing outside the priorities of public debate? Amidst these violations and the accumulation of economic, health, and security crises, how do most residents of Lebanese cities live? And what interventions are needed from the state today?

The Housing Crisis is Historical

Legislation pertaining to housing issued since 1943 and their relationship with the social, economic, and political developments show that the state’s housing interventions have followed three trends in three distinct phases.

1943-1962: Sporadic Laws to Control Rent or Respond to Crises

During this phase, Beirut witnessed enormous growth. This growth stemmed from a series of developments in the region in the late 1940s and early 1950s, such as the rapid accumulation of capital during the Second World War; the influx of capital from Palestine, Egypt, Syria, and the Gulf due to occupation and nationalization; and the rapid exploitation of Arab oil fields. With economic activity centralized in the capital city, many rural residents migrated to the cities. Renting was a key means of accessing housing, and ownership was uncommon among city residents. The laws of this phase came in the form of responses to earthquakes and floods, and laws that aimed to control rent but did not address more comprehensive housing policies that model people’s diverse needs and regulate urbanization in inclusive ways. Hence, the only housing solution available to low-income groups often seemed to be to build on public properties or private properties not registered in their name, or rent or purchase properties from non-registered holders of the property. Consequently, during this phase, informal settlements spread in all Lebanese cities, most notably Beirut, Tripoli, Tyre, and Sidon.

1962-1992: A Marginal Housing Policy

During the “Chehabist phase”, the authorities adopted a new policy based on strengthening the role of the central state and reinforcing its institutions. The existing governmental institutions were regulated, and new ones were established. The state created one housing institution after another, the most prominent being the Ministry of Housing and Municipalities in 1973 (which was abolished in 2000). It gave them certain roles in providing housing to some underprivileged groups, albeit without any comprehensive and integrated vision for achieving universal access to adequate housing. Between 1950 and 1975, the population of Beirut rose from 300,000 to 1.2 million, and the number rose further following the Israeli occupation of Southern Lebanon and the subsequent displacement of inhabitants to Beirut and its suburbs. The absence of a national policy for affordable land contributed to the expansion of informal settlements, especially in Beirut. The disintegration and undermining of the central state during the civil war years led to the near-terminal collapse of the state institutions, including those concerned with housing. In the wake of the war, the institutions needed to provide adequate, accessible, and safe housing for all were not reconstructed. Instead, the above situation was exploited to strengthen private sector interests at the expense of public interest, and to exempt the state from its responsibility to foster the right to housing.

1992-2020: A Policy Serving Capital

When the Lebanese civil war ended, a wide-scale neoliberal phase set in and witnessed enormous investments to reestablish Beirut as a center for regional services. Successive governments worked to ease conditions for local and foreign property investors, and the ratios restricting the portion of a property that can be built upon were relaxed. An institutional framework for property investment that provided incentives to investors and lowered investment taxes was established. With the increasing demand for buildings and the surplus liquidity in the banks, a policy based on lending for homeownership arose. The central bank’s status as custodian of this policy reduced the state’s housing policy to fulfilling the interest of banks and investors under the pretext of the sanctity of private property. The rent control system ceased applying to new contracts and was replaced with an investment-based rent system characterized by contractual freedom. Leases signed before 1992, which became inconsistent with the insane rise of property prices, were converted [to follow the new system] in accordance with the needs of the property market and interests of developers. Hence, the rate of evictions from the city to remote suburbs escalated in the absence of public transport, vacant high-rise buildings replaced historical neighborhoods, and miserable and inadequate housing arrangements proliferated in cities’ neighborhoods and suburbs. In the end, after successfully transforming the struggle for – and common interest in – access to housing rights into individual battles, the national housing policy, having been reduced to a policy of bank loans, collapsed.

The Inability to Repay Loans: The First Manifestation of the Crisis

When the current economic crisis began and jobs, job opportunities, and salaries began to decline, some families became unable to pay monthly home loan installments. In December 2019, Public Works Studio’s Housing Monitor launched a survey to monitor cases of default. In just three days, it received 127 cases. Although a law was issued to suspend debt installments and financial dues for banks and “comptoirs” [non-bank lenders], it did not specify how the payments due would be scheduled or repaid, or encompass the period before 17 October [2019, when the Lebanese uprising began].

Today, there are approximately 138,000 home loans subsidized by the central bank. Sixty percent are from the Public Corporation for Housing (PCH), while the rest are distributed across private banks. The PCH’s loans constituted approximately 70% of the 127 cases of default. The borrower’s income level is considered the main distinction between PCH loans and bank loans, as the PCH requires that this income not exceed ten times the minimum wage, i.e. USD 4,500. However, the average income of the defaulters who borrowed from banks was less than four times the minimum wage, thereby equalling the average income of those who borrowed from the PCH. This indicates that income level is a decisive factor in determining the likelihood of default during crises irrespective of the borrowing channel.

The vast majority of the 127 defaulting households have low incomes, i.e. incomes lower than LL3.375 million per month. In fact, more than 40% of these households were paying at least half of their monthly income in housing installments even before the livelihood crisis. Of those households, 20.5% lost the ability to pay due to loss of income. After the crisis began, the incomes of more than 75% of the households fell to less than half their value at the time of borrowing, while approximately 15% lost their entire monthly income. Hence, the figures clearly show that the crisis exacerbated inequality and further weakened a group that was already extremely precarious.

On this basis, we can deduce some of the ramifications of the home loans crisis on borrowers’ standard of living. By facilitating homeownership, the loans established a reality in the property market diametrically opposed to the living reality, which led to a gradual escalation in the burdens on the borrower’s shoulders. In other words, because money flowed to keep pace with rising property prices, instead of the prices being restrained to accord with households’ purchasing power, loans became a burden weighing down on households for 20 or 30 years amidst a precarious and unstable economic and livelihood situation.

Rent Precarity Amidst Successive Crises, Especially for Marginalized Groups

Today, rent is a key means of accessing housing in Lebanese cities by various social groups, with 49.5% of Beirut residents renting. However, the figures available are limited to registered legal leases and do not include customary arrangements not registered with the municipalities or made without written contracts.

All formal and informal residential neighborhoods, where more than half of Lebanon’s population lives, lack the rent controls needed to ensure adequate living conditions and protect residents from the risk of eviction and homelessness. And amidst the economic collapse that the ruling authority caused, in conjunction with the ever-escalating COVID-19 pandemic, half of Lebanon’s residents have fallen into poverty.

In particular, hundreds of thousands of foreign workers, migrant families, and foreign refugees face the increasing risk of losing their homes. They are among the groups most economically impacted by the successive general mobilization decisions, which have eliminated day labor opportunities, and the repercussions of the economic and livelihood crisis. Hence, the results of market-based policies and the absence of controls in the rental market, along with affordable and adequate housing solutions, are clearly evident, rendering the most socially and legally marginalized groups susceptible to the most heinous forms of exploitation and abuse.

According to the latest report by the Housing Monitor, eviction threats have escalated against renters unable to pay rent because they lost their jobs or source of livelihood amidst the successive crises engulfing the country. This issue began to emerge even before the first general mobilization was issued on 15 March 2020, which shows the extent to which the preceding economic crisis affected income levels.

One repercussion of the lack of housing policies is the phenomenon of dividing apartments into rentable rooms that are usually improvised, cramped, and crowded, without any controls on rent price or living conditions. Apartment owners meet the enormous demand for housing from a large segment of society unable to afford housing in the city by creating arrangements that sustain market profits in exchange for living conditions that are usually poor, while 50% of the city’s housing stock remains vacant without any accountability. The unequal relationship between property owner and renter produces a situation in which the obsession with increasing profits takes precedence over standards of safe and adequate housing. This is because of the lack of controls governing the leasing relationship, living conditions, and the management of private property in accordance with public interest (such as a taxation system that reduces vacancy). Besides the lack of space and crowding, defects in homes that harm health, such as mold, dampness, and frost, have become commonplace, as have poor services and structural problems. Homes that are infested with rodents and insects, lack sunlight, and smell of sewerage because rooms have been improvised near buildings’ sewerage facilities, which causes health problems in the long term, are also common. Moreover, the absence of controls and oversight “liberates” apartment and building owners from the burden of taking the necessary safety measures, such as maintaining buildings, rehabilitating homes, and providing safe conditions for residents.

In short, in the absence of rental market controls that tie rent value to the level of wages, there will be no protection for renters from the burdens of the increasing cost of renting, and the poor living conditions in many apartments and buildings will grow worse.

Compounding the Port Explosion Disaster by Exploiting People Worried About Their Housing

The absence of policies leads to an increase in instances and violent threats of arbitrary eviction. It also leads to overcrowded homes and displaced residents, making them more susceptible to COVID-19. The Beirut port explosion revealed the extent of residents’ precarity and the state’s poor administration, which exposes residents to further violence, instability, and health risks.

In Rmeil, an area affected by the explosion, 75% of residents are low-income renters, according to a study by the Lebanese University. Today, they are threatened with permanent displacement because of their precarious situation and the legal framework governing their presence in the city.

The Protecting and Supporting the Reconstruction of Areas Affected by the Beirut Port Explosion Law (Law no. 194/2020), which – according to its presenters – establishes a roadmap for rectifying the damage done to Beirut’s houses and neighborhoods and protects residents, merely extended residential and non-residential leases in affected buildings by one year. Hence, the residents are protected from eviction for one year from the law’s issuance. However, this period is insufficient given the severe economic, financial, and social crises ravaging society and the time it will take to repair these buildings, especially as the process of distributing compensation is slow and obscure. Furthermore, the law’s emphasis on the sanctity of private property and its connection to contractual freedom (even though rent control was the primary mechanism governing leases from the formation of the Lebanese state to 1992) poses an obstacle to guaranteeing the right to housing. Conversely, the law mentions no other “sanctified” rights guaranteed by the Constitution, such as the right to housing. Rather, what it classifies as a public interest justifying intervention in private ownership rights is limited to form and not use.

Consequently, in the absence of housing protection, evictions in areas affected by the explosion are on the rise. The Housing Monitor’s periodic report, which monitored evictions between September 3 and October 17, 2020, observed 58 threats of eviction against 190 people in various neighborhoods of Beirut. The largest number – 23 cases, i.e. approximately 40% – were in Karantina. After residents survived a terrible explosion, which caused them varying physical, material, and psychological harm, they now face threats of eviction that have been fulfilled in many cases.

Conclusion

Promoting the right to housing has become a clear priority. It is the cornerstone for constructing a new social contract based on justice, participation, and providing adequate, stable, and affordable housing that strengthens people’s relationships with their neighborhoods and socioeconomic networks. This priority requires an integrated and comprehensive vision that takes into account all segments of society, including families, workers, the elderly, women, people with disabilities, students, and refugees. The previous policies have not only been proven a failure by the economic collapse but were also long drawn up to serve narrow interests rather than public interest.

This article is an edited translation from Arabic.

[1] Joan Shaker, “Masraf Lubnan Yusakhkhir al-Iskan li-Ziyadat Arbah al-Masarif”, published on the website of Public Works Studio’s Housing Monitor.

[2] “al-Qurud al-Sakaniyya Tufaqim al-Lamusawa”, a report on the cases of home loan default reported to the Housing Monitor amidst the financial crises, Public Works Studio.