Lebanon’s Forensic Audit: Secrecy as the Magic Wand of Impunity

For approximately one month, Lebanon has been living in shock from the evaporation of one of the main promises that the ruling authority made to mitigate public outrage over the financial and economic collapse and show that it will reform government. The promise was broken when Riad Salame, governor of the central bank (the Banque du Liban), refused to comply with an information request by Alvarez & Marsal, the company charged by the Lebanese government with conducting a forensic audit, on the basis that it conflicted with the Banking Secrecy Law. Consequently, the company canceled its contract, citing obstructions.

Because the refusal to provide information was ascribed to the Banking Secrecy Law, it echoed another failure that paved the way for it months earlier, namely the defeat of the bills to lift public servants’ banking secrecy to one extent or another, which several political forces had boasted about submitting.

Previously, President Michel Aoun sent Parliament a letter calling upon it to take the appropriate decisions and measures to overcome the obstacles to the forensic audit. In fact, Parliament convened on November 27 and ultimately adopted a political resolution (devoid of any legal effect) requiring a forensic audit of all accounts of public administrations and municipalities irrespective of banking secrecy. On the other hand, Parliament has taken no measure to hold the central bank’s governor accountable or amend the laws concerning this secrecy.

On all the above, I would like to make three observations:

A Disguised Pardon for the Crime of Bankrupting Society

Irrespective of the validity of the central bank’s invocation of banking secrecy to deny the auditing company the requested documents (an issue to which we will return below), the outcome is the same, namely the suppression of culpability for the largest financial and economic collapse to occur in Lebanon and, in practice, the mistakes that the ruling system committed over the past decades. Hence, the situation resembles the passage of the General Amnesty Law in 1991. Just as that law erased the crimes of the 1975-1990 war and culpability for them, blocking the forensic audit erases the crimes of corruption committed during the decades since the war and allows the perpetrators to escape punishment. In both instances, the dignitaries of the era granted themselves a blanket self-pardon that restores the legitimacy of their rule while totally denying the rights of the victims and society.

The similarities between the two approaches go beyond their actual effect to include the spread of a justificatory discourse contending that the demands for accountability and justice must be dismissed not just for the needs of the future but also because doing so accords with the circumstances under which the crimes occurred in the past.

In 1991, besides the spread of the phrase “we’re all victims and we’re all criminals”, which undermined both victimhood and culpability by blurring the distinction between the two, the general pardon was portrayed as necessary to escape the state of war and construct civil peace because any form of accountability (even in terms of recognizing the victims’ rights by, for example, clarifying the fate of missing persons) could ignite another war.

In 2020, the argument for thwarting accountability, namely the preservation of banking secrecy, has also been portrayed as an inevitability that is in society’s interest to concede, most notably by deputy Parliament speaker Elie Ferzli. He deemed preserving this secrecy necessary for the sake of our legislative and banking history (i.e. a pledge we made to depositors to attract their wealth) and the future (i.e. recovering Lebanon’s former prosperity).

In relation to the past, Ferzli argued, “There are foreigners who came and put their money in Lebanon… What gives me the right to expose them to all kinds of prosecution in their countries by lifting their banking secrecy? When someone comes and says that they will deposit money with me because I provide banking secrecy, what gives me the right as a party to breach the contract and lift it? I believe that they can then sue the state for breaching the contract that the two parties signed”.[1]

While Ferzli’s talk of a contract between the state and depositors and the possibility that they will sue it is an absurd sophism, it aims to achieve two things.

The first is to establish that society, which reaped the benefits of this secrecy (namely the flow of capital into Lebanese banks), should bear its cost. In other words, it should accept any potential negative consequences, even if they include the suppression of all financial culpability. In this regard, he contended, “Were it not for banking secrecy, we would not, even today… be living with hope in tomorrow”.

The second is to turn the discussion about how to restore international trust in Lebanon on its head. A discourse had spread holding that the forensic audit is a precondition for restoring international trust in Lebanon and obtaining loans now desperately needed to overcome the crisis. Ferzli, with his experience in oration, flipped this logic by reducing international trust to foreign depositors’ trust in Lebanon, which will undoubtedly be disturbed should any impingement on banking secrecy occur. He even asked, “What’s the purpose of systematically destroying this international community’s trust in what’s left in Lebanon due to banking secrecy in order to please one person or another?”

Regarding the needs of the future, Ferzli’s statement again took on an existential character that leaves no room for disagreement, deeming banking secrecy a fundamental precondition for rebuilding the economy: “If I were to lift banking secrecy in the future, then by God tell me, what will we live off? Apples and grapes…?” He continued, “How can a worker find himself work when capital doesn’t come to Lebanon. If there’s no capital, how can we create factories and other work whereby Lebanon could recover its former prosperity and economy?” On this basis, he concluded that any talk of abolishing banking secrecy is an “abuse of the country’s supreme economic and monetary interest”.

From this angle, Ferzli (as a true expression of the attitude of the prevailing system) seemed to be confronting Lebanese people with the same choice they faced after the war ended: either they insist on accountability and truth, which would not suit the circumstances and commitments of the past anyway, or they chose hope in the future, which can only be built by forgetting, turning the page on the past, and letting bygones be bygones.

Hence, just as the ruling regime suppressed the whereabouts of mass graves in the post-war decades, it is now suppressing the forensic audit using banking secrecy. In effect, both stances prevent the involvement of the warlords-turned-peacetime-rulers from being exposed for their crimes and corruption, and transforms the spoils they reaped in each era into acquired rights not subject to any accountability, thereby laundering their images as well as their money.

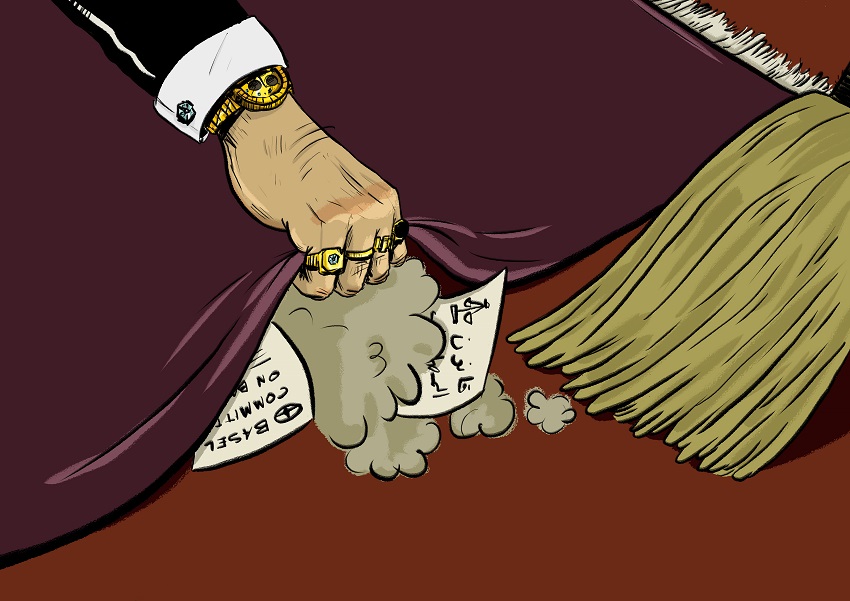

Secrecy as the Magic Wand for Demanding Accountability While Evading It

Irrespective of the pertinence or necessity of preserving banking secrecy, the contention over the forensic audit’s fate clearly shows its pivotal role in thwarting any accountability, not just for the past but also in the future. Because of this secrecy, the talk of combating corruption remains hypothetical and lacking evidence and proof. While the Money Laundering Law (2015) created a mechanism for lifting secrecy, this enormous power was placed in the hands of one authority – namely the Special Investigation Commission established inside the central bank – whose decisions are not open to any appeal. This commission is headed by the bank’s governor, and his control over its decisions grants him extra power on top of his already-inflated authority in the financial and monetary realms. The scope of his power recently became very evident via several circulars and decisions:

- Circular no. 154, issued by the central bank’s Central Council on 27 August 2020. This circular obliged people who transferred their money abroad to return a portion of it (15-30%) or face prosecution for money laundering or tax evasion. The central bank thereby seemed to reveal that it is aware of many crimes committed and may excuse or effect accountability for them based on whatever conditions it deems fit. Moreover, the circular shows that via its control over this secrecy, the central bank has the ability to discriminate, extort, and grant a general amnesty, which completely contradicts the minimum principles of democracy and justice.

- The Special Investigating Commission’s decision to withhold any information about the people and bodies that managed to transfer vast sums abroad after 17 October 2019, despite the destructive effect of these transfers on society as a whole, on the pretext that no suspicions of money laundering have emerged in connection with them.

- The Special Investigating Authority’s decision, which Public Prosecutor in Mount Lebanon Ghada Aoun revealed in a televised interview,[2] to withhold any information about suspects in corruption that are thought to have, with no exaggeration, squandered billions of USD. Such parties include the companies, people, and public servants embroiled in the Sonatrach contaminated fuel case.

All the above indicates that banking secrecy has, for those with influence, become a magic wand for turning all their actions and wealth invisible whenever they sense that they are being targeted by any serious investigation or demand for accountability. It allows them to hypocritically combine two contradictory stances, as the ruling regime desperately needs to do especially at this delicate stage of Lebanese history (which we hope will become a watershed). On one hand, they can loudly tout combating corruption and propose one such law after another to placate international demands and con the public. On the other hand, they can obstruct the exposure of their culpability in the corruption, or at least its grossest forms, thereby sparing themselves from the laws they enact. In other words, they can play the role of reformer and capitalize on its benefits without bearing any of its consequences. Hence, the laudation of banking secrecy and emphasis on the importance of preserving it can be expected to increase as pressure for elaborate legislations to punish corruption and restrict or remove immunities mounts, or judicial independence strengthens in one way or another.

Finally, it should be noted that banking secrecy is not the only secrecy used as a magic wand. Other prominent examples include the recent debates over the new illicit enrichment law, debates that ultimately dismissed all the proposals to make top officials’ and public servants’ wealth disclosures public, as they are in many democratic states including the nascent democracy in Tunisia. This secrecy prevents citizens from alleging that these disclosures have been falsified and, in combination with banking secrecy, prevents them from knowing how the officials’ wealth evolves over time and thereby proving illicit enrichment. Similarly, the secrecy of investigations by Public Prosecution offices and investigating judges is used to distort facts. Furthermore, the secrecy of discussions inside the legislative kitchen – i.e. the parliamentary committees – is used to slip poison into its dishes unseen. In this regard, Parliament’s Bureau has refused to place any of the expedited proposals to make these discussions public on the General Assembly’s agenda.

Terminating the Forensic Audit is Primarily a Political Choice

While the controversy over the validity of the central bank’s decision to withhold information seemed like a legal debate over the effects of banking secrecy, recent developments clearly show that the issue is primarily political.

This became evident when the MPs refused to enable the judiciary to lift secrecy after many changed their stance and favored amending the bill to lift secrecy imposed on public servants drafted by the parliamentary committee established specifically to expedite the adoption of anti-corruption laws. Ultimately, Parliament restricted the ability to lift banking secrecy to two bodies – namely the aforementioned Special Investigation Commission and the National Anti-Corruption Authority, which has not yet been established – and thereby stripped the judiciary of any such power. Remarkably, during the general assembly, most MPs refused a proposal for this law lifting secrecy to encompass the directors of banks, not just associations, and even MP Bilal Abdallah emphasized the need for the entire private sector be excluded pursuant to the liberal system even though he, per his own words, believes in socialism. Although President Michel Aoun returned the passed bill to Parliament via Decree no. 6490/2000, asking it to reconsider the denial of any role for the judiciary in lifting secrecy, Parliament has so far taken no initiative in this regard, even after the forensic audit was blocked based on the Banking Secrecy Law. On the contrary, some MPs have submitted new, limited proposals, the most prominent being Georges Adwan’s bill to lift banking secrecy for a single year.

This article is an edited translation from Arabic.

[1] “al-Ferzli Dafa’a ‘an Raf’ al-Sirriyya al-Masrafiyya: Lawlaha Lama Kunna Hatta al-Yawm .. wa-La li-l-Kaydiyyat”, El Shark Online, 4 November 2020.

[2] In the contaminated fuel case, Judge Ghada Aoun said in an interview on LBC, “I didn’t accommodate anyone in this case. The Special Investigation Committee … hasn’t responded to what I requested for a year… I need an account statement. I’m prepared to resign today. I don’t want to be a false witness. The most important body for exposing corruption and theft of public funds is the Special Investigation Committee, and it doesn’t want to operate and is dragging its feet in this case… In money laundering cases, there is no law that requires going through the cassation public prosecutor. We want information and to reach the truth”.